Economics & Finance Trends - February 2, 2026

Rate U-turns, bond market defiance, and China's reserve currency ambitions shape Feb 2026.

Global Economic Crossroads: Rate Hikes, Bond Market Jitters, and the Yuan's Ascent

Economic Trends: Diverging Paths and Shifting Sands

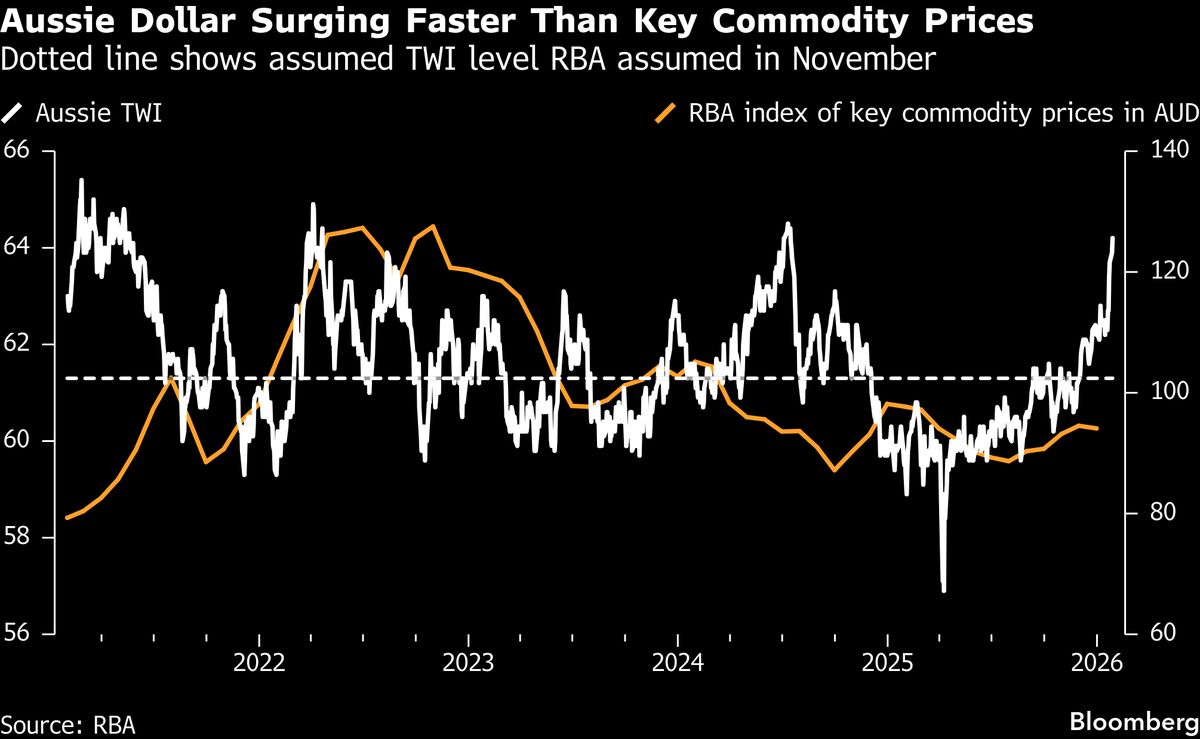

Central banks are signaling a potential pivot in monetary policy, but not all are singing from the same hymn sheet. The Reserve Bank of Australia (RBA) is reportedly set for a rate hike, a move that conspicuously breaks from the global trend of easing or holding steady. This divergence suggests the RBA is prioritizing domestic inflation concerns over international synchronicity, a bold stance that could either tame runaway prices or stifle economic growth if inflation proves stubborn.

The implications are significant: Australian consumers and businesses face higher borrowing costs, potentially impacting investment and spending. Meanwhile, the Australian dollar could see a boost, making imports cheaper but exports more expensive. This independent streak highlights the localized nature of economic pressures, even in an interconnected world.

Across the Pacific, America's bond market is facing its own unique brand of defiance. The question isn't just if it can withstand pressure, but how it's managed to do so thus far. Vigilantes, often short-sellers or investors betting on price declines, typically target markets showing signs of overvaluation or unsustainable debt. The resilience of the US bond market, therefore, points to underlying strengths or perhaps a collective belief in the Federal Reserve's ability to manage its way through potential headwinds.

However, the "January barometer" for stocks comes with a significant asterisk this year, as noted by MarketWatch. This traditional indicator, which suggests that a positive stock market performance in January bodes well for the rest of the year, is clouded by unusual circumstances. Investors are advised to temper optimism, as the usual predictive power might be compromised by unique market dynamics or external shocks. This uncertainty underscores the need for a discerning investment approach, rather than relying on historical patterns alone.

Meanwhile, China's ambition to elevate the renminbi to global reserve currency status is a long-term play with profound geopolitical and economic ramifications. As reported by the Financial Times, Xi Jinping's call signals a strategic push to challenge the dollar's dominance. While a full transition is years, if not decades, away, any progress in internationalizing the yuan could dilute the impact of US sanctions and reshape global trade finance. This narrative is crucial for understanding the evolving geopolitics of finance.

These disparate trends – a hawkish RBA, a resilient US bond market, a questionable January stock effect, and China's currency ambitions – paint a complex picture. Investors and policymakers must navigate a landscape where national economic priorities are increasingly taking precedence, and traditional market indicators may offer less reliable guidance.

Market Insights: Navigating Volatility and Emerging Assets

The current economic climate, characterized by diverging monetary policies and market uncertainties, demands a strategic approach to portfolio management. The RBA's hawkish stance, while potentially beneficial for controlling inflation, introduces volatility for Australian assets and could influence regional currency markets. Investors should assess their exposure to interest-rate sensitive sectors within Australia.

The resilience of the US bond market, despite potential 'vigilante' pressures, suggests a cautious optimism or a belief in the Fed's capacity to maintain stability. However, the "January barometer" caveat is a stark reminder that past performance is not indicative of future results. This implies a need for diversification and a focus on quality assets that can weather unpredictable market swings.

On the fringes of traditional finance, the mention of iShares Silver Trust (Ondo Tokenized Stock) (SLVON), ranked 742, hints at the growing intersection of traditional assets and tokenization. While its specific market impact at this rank is minimal, its existence signifies a broader trend: the exploration of blockchain technology to represent and trade real-world assets. For forward-thinking investors, understanding these nascent digital representations of physical commodities or equity is key to identifying potential disruptive investment opportunities in the long run. The "so what?" here is that the lines between physical and digital assets are blurring, requiring a new lens for evaluation.

Finally, China's push for renminbi internationalization, though a macro trend, has micro implications for companies operating in or trading with China. A stronger, more internationally accepted yuan could alter transaction costs and currency risk management strategies. Investors should monitor developments in cross-border payments and yuan-denominated financial instruments.

References

- RBA Set for U-Turn to Rate Hike in Break From Global Trend - Bloomberg Markets

- Can America’s bond market keep defying the vigilantes? - The Economist

- Xi calls for China’s renminbi to attain global reserve currency status - Financial Times

- The ‘January barometer’ for stocks comes with a big asterisk this year - MarketWatch

- iShares Silver Trust (Ondo Tokenized Stock) (SLVON) - CoinGecko

Related Posts

Economics & Finance Trends - February 1, 2026

Oil market jitters, investor stock choices, and crypto's rise analyzed for February 1, 2026.

2026년 2월 1일Economics & Finance Trends - January 31, 2026

Fed probe sparks debate, book ignites country analysis, Venezuela amnesty, Warsh's Fed impact.

2026년 1월 31일Economics & Finance Trends - January 30, 2026

Geopolitical rifts widen, shaking investor confidence across asset classes.

2026년 1월 30일